Overview

Recording your BAS payments in Xero is easy once you've seen it done, this brief article shows you how step by step.

As you record your income and expenses in Xero, the GST portion of the transaction gets allocated to your GST ledger account. At the end of each BAS period you need to record an entry to clear out the GST that has accumulated in that account. It's important to do this because it allows you or your accountant to confirm that all of your GST has been reported to the ATO correctly.

If you have a bookkeeper or accountant preparing your BAS statements then they will (probably) do this step for you. If you're doing it yourself then for many small business owners, this is the most complex thing you'll need to record in xero. The good news is that it's fairly straight forward once you know how.

Step 1 - Take a Look at your BAS

Take a look at your finalised BAS and note the amounts that comprise the amount payable. This will include GST collected at 1A, GST paid at 1B, as well as your Fuel Tax Credits and Pay As You Go Withholding if thats applicable to you.

As an example, lets say these amounts look like this:

| Description | Label | Amount |

|---|---|---|

| GST Collected | 1A | $ 5,000 |

| GST Paid | 1B | - $ 1,000 |

| PAYG Withheld | W2 | $ 2,000 |

| Fuel Tax Credits | - $ 500 | |

| Total Payable | $ 5,500 |

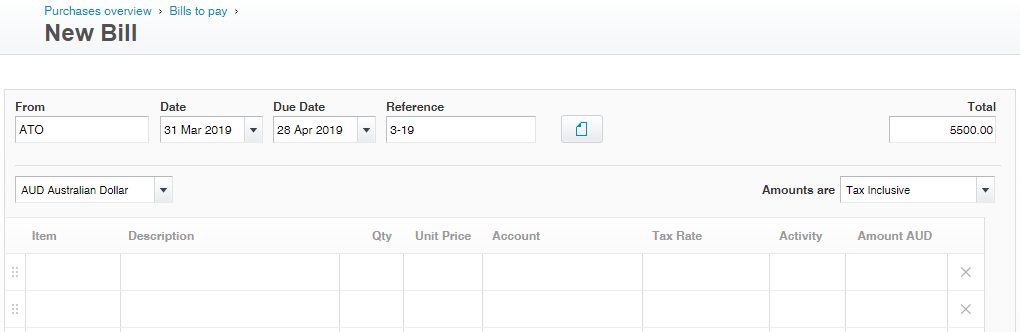

Step 2 - Create a Bill in Xero

Log into Xero and navigate to Business > Bills to Pay then New Bill.

Fill out the fields as follows:

- From : "ATO" or "Australian Tax Office" as you prefer

- Date : it's important to set this to the last day of the period, don't just put the current date.

- Due Date : 28 days from the last day of the period. You might like to bring that forward a couple of days to allow time for the transaction to clear.

- Reference : You can put whatever you want here but I like to include something to identify the BAS period. In this case

3-19refers to the third quarter of 2019. - Attachments : Why not attach a copy of your BAS here just in case someone needs to check this transaction later.

- Total : Put the total amount payable here.

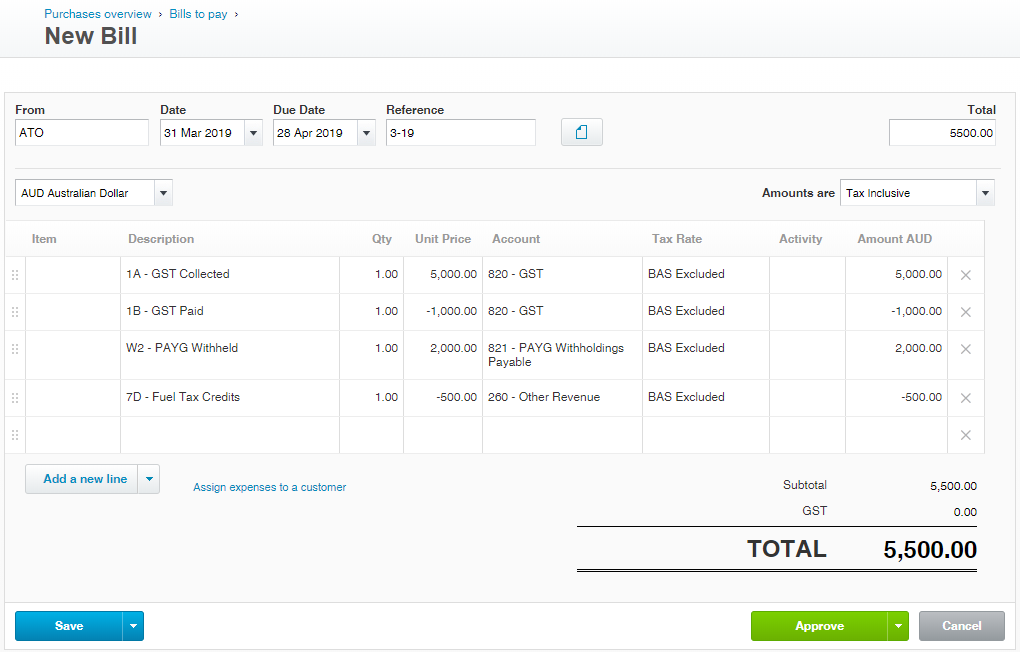

Step 3 - Record a Line Item for Each Component

Record a line item on the bill, one for each of the components applicable to you. A few things to keep in mind:

- the credits (GST Paid, and FTC, in this example) should be recorded as negative amounts.

- note the correct accounts as shown

- choose the

BAS ExcludedTax Rate for all line items - the final total should match the total payable

Step 4 - Approve the Bill, Ready to Reconcile

Approve the bill, then treat it as you would any other Bill.

Other Issues

You should review your ATO Integrated Client Account from time to time. If there's any other activity, like interest or penalties, on this account, then these should be included on this bill as well.